- Basic Views and Guidelines on Corporate Governance

- Overview of Corporate Governance System

- Views on Board Talent

- Evaluation Results on the Effectiveness of the Board of Directors

- Remuneration for Directors, etc.

- Succession Planning

- Cross-Shareholdings

- Strengthening Internal Controls

- Related Data

Basic Views and Guidelines on Corporate Governance

Basic Views on Corporate Governance

Based on the “Furukawa Electric Group Purpose” and the “Core Values,” Furukawa Electric and Furukawa Electric Group strive to enhance business performance by improving management efficiency—including accelerating decision-making—while ensuring transparency and fairness, and by responding swiftly to changes in the business and market environment. At the same time, we maintain sound management through the establishment, reinforcement, and effective implementation of the internal control system. With these, we will expand and develop our business on a sustainable basis and increase our corporate value. Furthermore, we seek to enhance our corporate governance, in accordance with the followings:

Guidelines on Corporate Governance

Based on “Basic Views on Corporate Governance”, we adopted “Guidelines on Corporate Governance (PDF328KB) (hereinafter referred to as “the Guidelines”)” as a policy for enhancing our corporate governance.

Corporate Governance Report

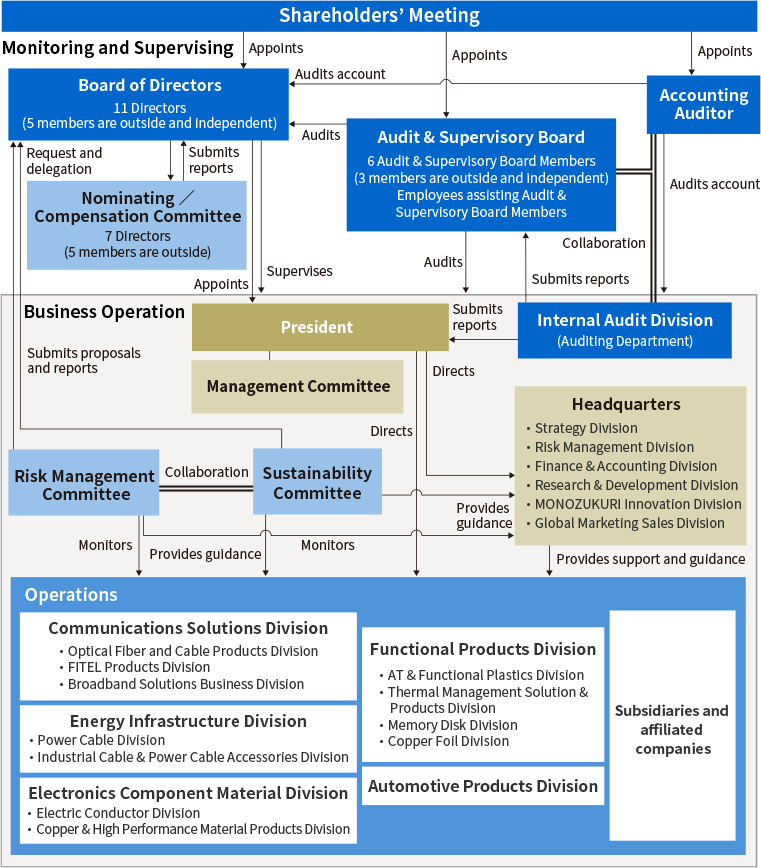

Overview of Corporate Governance System

The Company adopted the current corporate governance system (in the organizational form of Company with an Audit & Supervisory Committee) to further expedite decision-making by delegating broad-ranging decisions on business execution to the management, and to strengthen/sophisticate the supervisory function of the Board of Directors by holding essential discussions on agenda items centered around the management policy and management strategy, thereby promoting the enhancement of corporate governance.

Furthermore, to complement the supervisory function of the Board of Directors, the Company established Nominating/Compensation Committee. The Committee consists of at least five members (where Outside Directors comprises a majority) who are chosen among Directors by resolution of the Board of Directors; and the Committee Chair is, in principle, selected from Outside Directors by the Committee members.

Corporate Governance Organization Chart

Monitoring and supervising function

Board of Directors

In light of its fiduciary responsibility and accountability to shareholders, the Board of Directors of the Company fulfills its responsibilities to promote sustainable corporate growth and the increase of corporate value over the medium-to-long-term, and enhance earnings power and capital efficiency; and therefore, do the following:

For further details, please refer to “Board of Directors” of Chapter 3, Section 2 of the Guidelines (Guidelines on Corporate Governance (PDF)).

As of June 25, 2025, the Board of Directors of the Company consists of 11 Directors(including four Outside Directors (excluding Directors who serve as Audit & Supervisory Committee Members) and two Outside Directors who serve as Audit & Supervisory Committee Members, and all of whom are registered with the Tokyo Stock Exchange independent officers). The Board of Directors is chaired by non-executive Director and Chairman of the Board who does not have representative rights.

The Outside Officers of the Company have extensive management experience in financial institutions, trading companies, and business corporations or expert knowledge and experience in such areas as finance/accounting, and industrial policies, etc. The Board of Directors, in making decisions, respects Outside Directors’ opinions and suggestions from diverse viewpoints based on their experience.

Nominating/Compensation Committee

We established Nominating/Compensation Committee for the purpose of ensuring objectivity and transparency in deliberation and decision-making procedures concerning nomination of Directors and other officers and their remuneration. Nominating/Compensation Committee consists of 5 or more members who are selected from among the Directors by a resolution of the Board of Directors, and a majority of them are Independent Directors. In principle, the Chairperson is appointed from Independent Directors and by mutual vote.

For further details, please refer to “Nominating/Compensation Committee” of Chapter 3, Section 3 of the Guidelines (Guidelines on Corporate Governance (PDF)).

The Committee comprises eight members, and six members, including the chairperson, are Outside Directors.

Audit & Supervisory Committee

Audit & Supervisory Committee collects information about management under statutory investigation authority and express their views to the Board Meetings and the Management from an independent and objective standpoint as a fiduciary to shareholders. Furthermore, Audit & Supervisory Committee shall ensure adequate cooperation with the Internal Audit Department (i.e. Auditing Department) by holding regular meetings and receiving reports as necessary. In addition, Audit & Supervisory Committee regularly report on their audit policy and plan as well as audit results to Board of Directors regularly.

Furthermore, The directors, who serves as full-time Audit & Supervisory Committee Member attend the important meetings such as the Management Committee which decides major business matters, and they report information obtained from these meetings and audit activities to Outside Directors who serves as an Audit & Supervisory Committee Member.

In addition, Assistant staff that is independent of the Management is appointed to assist activities of Audit & Supervisory Committee and Audit & Supervisory Committee operation to enhance audit functions.

For further details, please refer to “Audit & Supervisory Committee” of Chapter 3, Section 4 of the Guidelines (Guidelines on Corporate Governance (PDF)).

Audit & Supervisory Committee comprises three Audit & Supervisory Committee Members (including two Outside Directors who serve as Audit & Supervisory Committee Members, all of whom are registered with the Tokyo Stock Exchange independent officers).

Business execution function

Furukawa Electric Group’s business consists of 13 operating divisions and others; and business divisions were established for directing and overseeing multiple operating divisions which are closely related to each other. As for our business execution, under the control of President being the chief executive, operations are directed by General Managers of Communications Solutions Division, Energy Infrastructure Division, Electronics Component Material Division, Functional Products Division, Automotive Products Division, and Optical Solutions Division, as well as Advisor of FITEL Products Division and General Manager of FITEL Products Division. In addition, the Company has divisions to perform such head office functions as developing and implementing the Group’s business strategies/management plans, establishing and maintaining corporate governance, risk management, and other management systems, and conducting marketing and sales activities; and General Managers of respective divisions lead such functions. These General Managers, in the capacity of executive officers, serve as members of Management Committee, which is the highest decision-making body of business execution. Management Committee deliberates and determines major operational matters to ensure effective communications among the executive officers, thus achieving integrated business execution.

Furthermore, the status of business execution is reported to the Board of Directors on a quarterly basis.

Views on Board Talent

Policy on Nomination of Candidates for Board of Directors and Executive Officers

With respect to board members (Board of Directors and Executive Officers), the Company believes that their skills, knowledge and experience, as well as multiple views from diverse board members, in terms of gender and international experience, contribute to the Group’s global business operations and appropriate oversight/auditing. Based on this perception, the Company selects candidates for board members as follows:

-

Candidates

for Outside DirectorTotal mix of various skills and backgrounds in the expectation that they will contribute to the Board discussions from diverse perspectives and viewpoints; a person with experience of corporate management and governmental body, an engineer with specific technological expertise, and an expert of law or accounting

-

Candidates for Inside Director

and Executive OfficerWith the consideration of the Furukawa Electric group business with many affiliates around the globe and various business lines, a person who has the sufficient skillset, knowledge and experience required for each position in accordance with the circumstances as they arise and contributes to the Furukawa Electric corporate value

Key areas (skillsets) of experience and knowledge that we expect our directors to possess

In the Group, “materiality” is defined as key issues to be addressed for realizing Furukawa Electric Group Vision 2030. The Group identified the following materiality from the perspective of revenue opportunities and risks. In order to resolve these materialities, we have selected eight key areas (skillsets) of experience and knowledge that we expect our directors to possess: Corporate management, Finance/Accounting, Legal affairs/Risk management, Environment/Energy, Technology/IT, Sales/Marketing, International experience/knowledge, and Personnel policy/Organizational development.

Details of skillset were determined upon deliberation at the Nominating/Compensation Committee, and will be updated, as necessary, considering the external environment as well as the Company’s management plan/business characteristics, among others.

Relationship between Material issues and Skillsets

| Material issues | Skillsets | ||

|---|---|---|---|

| Revenue opportunities | Creating businesses that solve social issues |  |

Finance/Accounting Technology/IT Sales/Marketing |

| Open,Agile,Innovative |  |

Corporate management Technology/IT Sales/Marketing |

|

| Building partnerships with various stakeholders |  |

Technology/IT International experience/knowledge |

|

| Risks |

|

|

Environment/Energy |

|

|

|

Personnel policy/Organizational development | |

|

|

|

Legal affairs/Risk management | |

Details of skillsets

| Skillsets | Reason for selection | Definition |

|---|---|---|

|

Corporate management |

To promote ESG management aiming at the Group’s sustainable growth and increase in corporate value over the mid- to long-term, and proactively work on self-transformation, skills in formulating mid- to long-term sustainable growth strategy and high level of skills in corporate management are required. | Have experience in serving as Representative Director or equivalent (i.e. an officer with a broad scope of responsibilities that are similar to that of an officer) |

Finance/ Accounting |

To strengthen/create capital efficient businesses of the Group, and optimize its business portfolio, high level of skills in accurately identifying the financial situation and formulating financial/capital strategy toward establishing the solid financial base are required. | Have experience/expertise in finance/accounting; have significant experience as the person in charge of finance/accounting division |

Legal affairs/ Risk management |

Establishing a governance structure for strengthening risk management and ensuring a corporate culture of compliance are the foundation of continued increase in corporate value. To improve the Board’s effectiveness in terms of overseeing the management as well, high level of skills in legal affairs, risk management and compliance are required. | Have experience/expertise in establishing legal/risk management/ compliance system, etc.; have significant experience as the person in charge of legal affairs/risk management/compliance division |

Environment/ Energy |

Since it is essential for the Group’s sustainable growth to promote climate-conscious business activities and have high level of skills in environment/energy area. | Have extensive experience, expertise and/or network in the area of environment/energy; or have significant experience as the person in charge of environment/energy division |

Technology/IT |

To enhance the Group’s strengths, including open innovation, co-creation with external partners, and the use of intellectual properties, and develop a new business model, 4 core technologies (note) which the Group has developed, or high level of skills in the digital area are required. | Have experience/expertise in R&D, IT, DX, etc.; have significant experience as the person in charge of technology/IT division |

Sales/Marketing |

To move away from the product-out mindset, adopt market-in and even outside-in approaches, and provide customers with solutions by taking advantage of the Group’s strengths, high level of skills in forecasting market trends and formulating sales strategy are required. | Have experience/expertise in sales/marketing; have significant experience as the person in charge of sales/marketing division |

International experience/ knowledge |

To strengthen the Group’s businesses, high level of skills in formulating growth strategy from the global viewpoint as well as managing overseas businesses are required. | Have experience in running a company abroad or have international knowledge of international trade or a relevant specialized area |

Personnel policy/ Organizational development |

To strengthen human capital management and organizational execution abilities, and thus strengthen the foundation for corporate management, high level of skills in formulating measures to ensure that employees demonstrate their abilities to the maximum extent and to strengthen team capability through leadership development and reform of organizational culture are required. | Have experience/expertise in personnel policy/organizational development; or have significant experience as the person in charge of personnel policy/organizational development division |

(note)4 core technologies:Metals, Polymers, Photonics, High Frequency

Skill Matrix of Board of Directors

| Directors | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Audit & Supervisory Committee Members) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

| Name | Keiichi Kobayashi | Hideya Moridaira | Satoshi Miyamoto | Koji Aoshima |

Takashi Tsukamoto | Yukiko Yabu | Tamotsu Saito | Takeo Hoshino | Hiroyuki Ogiwara | Sayaka Sumida | Takao Shiomi | |

| Position | Director and Chairman of the Board | Representative Director and President | Representative Director and Corporate Executive Vice President, and General Manager of Strategy Division |

Representative Director and Corporate Senior Vice President, and General Manager of Finance & Accounting Division |

Outside Director | Outside Director | Outside Director | Outside Director | Director (Full-time Audit & Supervisory Committee Member) | Outside Director (Audit & Supervisory Committee Member) | Outside Director (Audit & Supervisory Committee Member) | |

| Gender | Male | Male | Male | Male | Male | Female | Male | Male | Male | Female | Male | |

| Tenure | 10 years | 3 years | 6 years | 1 year | 4 years | 6 years | 4 years | 1 year | 2 years (note 2) |

5 years (note 2) |

4 years (note 2) |

|

| Independent | ★ | ★ | ★ | ★ | ★ | ★ | ||||||

| Skills (note 1) | Corporate management | ● | ● | ● | ● | ● | ● | |||||

| Finance/ Accounting | ● | ● | ● | ● | ● | |||||||

| Legal affairs/ Risk management | ● | ● | ||||||||||

| Environment/ Energy | ● | |||||||||||

| Technology/ IT | ● | ● | ● | ● | ● | |||||||

| Sales/ Marketing | ● | ● | ||||||||||

| International experience/ knowledge | ● | ● | ● | ● | ● | ● | ● | |||||

| Personnel policy/ Organizational development | ● | ● | ||||||||||

| Board Meeting Attendance (FY2024) | 100% (16/16) |

100% (16/16) |

100% (16/16) |

100% (12/12) (note 3) |

93.8% (15/16) |

100% (16/16) |

100% (16/16) |

100% (12/12) (note 3) |

100% (16/16) |

100% (16/16) |

100% (16/16) |

|

| Nominating/ Compensation Committee Attendance (FY2024) | 100% (5/5) |

100% (5/5) |

— | — | 100% (5/5) |

100% (5/5) |

100% (5/5) |

100% (5/5) |

— | — | — | |

| Audit & Supervisory Committee Attendance (FY2024) | — | — | — | — | — | — | — | — | 100% (11/11) |

100% (11/11) |

100% (11/11) |

|

(note 1)The above tables do not cover all experience/knowledge of each person. A check-mark is placed only in case where the Company expects that a person’s extensive experience/knowledge in each item will particularly contribute to solving key issues.

(note 2)The Company transitioned to a Company with an Audit & Supervisory Committee on June 25, 2025. The tenure of Directors who are Audit & Supervisory Committee Members includes their period of service as Audit & Supervisory Board Members.

(note 3)Since Mr. Koji Aoshima and Mr. Takeo Hoshino were newly elected at the 202nd Annual Shareholders Meeting held on June 26, 2024, the number of the eligible Board of Directors meetings is different from that for other members of the Board of Directors.

Independence for Outside Directors

In principle, a majority of the Company’s directors shall be independent outside directors, and the Company has established the independence standards for outside directors as follows.

Independence Standards for Outside Directors specified by the Company

If none of the following attributes are applicable to the relevant Outside Directors (including candidates), we consider that they are Independent Directors without the possibility of creating any conflict of interest with general shareholders.

(note) Even if any of the items ① to ⑦ is not applicable, the Company may determine that the person is not independent depending on factors such as the amount of transactions at subsidiaries of the Company or those of the relevant client to which the person belongs.

Evaluation Results on the Effectiveness of the Board of Directors

Our Company has conducted an annual analysis and evaluation on the effectiveness of the Board of Directors since FY2015, aiming at improving the Board’s functions through a continuous process where we verify whether the Board is functioning adequately, and based on the results, we take necessary measures to remedy issues and reinforce its strengths.

Method of analysis and evaluation

Upon conducting a questionnaire survey targeting all Directors and Audit & Supervisory Board Members, the effectiveness of the Board of Directors was discussed based on aggregated results at meetings of outside officers and the Board of Directors. For the purpose of obtaining deeper understanding of the aggregated results, the Chairman of the Board had interviews with all Directors and Audit & Supervisory Board Members on an individual basis (while the lead outside officer interviewed with the Chairman), and shared the results at the above-mentioned Board of Directors meeting.

Category of survey questions

Overview of analysis and evaluation results(FY2024)

As a result of the analysis and evaluation, we reconfirmed that our Board of Directors has worked on initiatives to enhance its effectiveness in consideration of the results of the last year’s evaluation; the Board of Directors as a whole has had positive and active discussions and carried out adequate oversight the business execution from the perspective of achieving sustainable growth of the entire Group and increasing corporate value over mid- to long-term; and useful recommendations/inputs based on a wealth of experience and advanced knowledge of outside officers were reflected on business execution. Consequently, we analyzed/evaluated that the Board of Directors maintained its effectiveness this year as well.

For details, please refer to Overview of Evaluation Results on the Effectiveness of the Board of Directors (FY2024).

Remuneration for Directors, etc.

Policies for determining remuneration, etc. for Directors, etc.

Basic policy

The remuneration for officers shall be determined in a way that encourages each officer to exert his/her abilities to the maximum level and proactively fulfill his/her duties so that the Group will increase its corporate value and achieve sustainable growth while contributing to the society through its business activities.

Policy for determining remuneration for individual officer by element

The Company’s remuneration for officers consists of base salary, short-term performance-linked remuneration (on an individual level), short-term performance-linked remuneration (on the company level), ESG-linked remuneration, and Medium-to-long-term performance-linked remuneration; and the Individual Remuneration Policy for determining an amount of each remuneration element is as follows:

| Element of remuneration | Overview | Recipient | |||

|---|---|---|---|---|---|

| Director except Outside Director (excluding Director who serves as Audit & Supervisory Committee Member) | Outside Director (excluding Director who serves as Audit & Supervisory Committee Member) | Corporate Vice President except Director, Senior Fellow | Directors who serve as Audit & Supervisory Committee Member | ||

| Base salary | This element is paid in cash in a fixed amount every month, and the amount is determined depending on his/her role (e.g. management oversight or business execution) and official position. | ● | ● | ● | ● |

| Short-term performance-linked remuneration (individual) | This element is paid in cash once a year, and the amount is determined by the Nominating/Compensation Committee upon comprehensively evaluating achievements of the relevant business plan in the previous fiscal year, such as operating income and Economic Value Added in the division(s) he/she is in charge of, and the status of relevant measures. | ● | - | ● | - |

| Short-term performance-linked remuneration (company level) | This element is paid in cash once a year, and the amount is fixed according to the evaluation criterion based on consolidated operating income, as defined by the Nominating/Compensation Committee. | ● | - | ● | - |

| ESG-linked remuneration | This element is to be paid in cash once a year. The amount is to be determined upon evaluating the progress toward achieving the sustainability targets of key management issues (materiality) to be addressed by the Group. | ● | - | ● | - |

| Medium-to-long-term performance-linked remuneration | This is the stock remuneration system, which provides the Company’s shares acquired by the Trust that was funded by the Company. | ● | - | ● | - |

For details, please refer to “4. Corporate Governance, (4) Remuneration for Directors, etc.” in the Annual Securities Report for the 203rd Fiscal Year (April 1, 2024 through March 31, 2025).

Remuneration for Directors and Audit & Supervisory Board Members (FY2024)

| Officer classification | Total remuneration (JPY millions) | Total remuneration by type (JPY millions) | Number of subject officers (persons) | |||||

|---|---|---|---|---|---|---|---|---|

| Base salary | Short-term performance-linked remuneration (individual) | Short-term performance-linked remuneration (company level) | ESG-linked remuneration | Medium-to-long-term performance-linked remuneration | ||||

| Directors (excluding Outside Directors) | 359 | 226 | 19 | - | 5 | 108 | 7 | |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) | 91 | 91 | - | - | - | - | 3 | |

| Outside Officers | 108 | 108 | - | - | - | - | 9 | |

| Of which Outside Directors | 72 | 72 | - | - | - | - | 6 | |

| Of which Outside Audit & Supervisory Board Members | 36 | 36 | - | - | - | - | 3 | |

(note 1) The amounts and numbers of officers in the above table include two Directors who retired from the positions due to the expiry of their terms at the end of the 202nd Annual Shareholders Meeting held on June 26, 2024 as well as amounts of their remuneration.

(note 2) The column of Short-term performance-linked remuneration (company level) shows the payment amount which was determined in June 2024 as compensation for execution of duties in FY2023. The amount for FY2024 is not yet fixed at the time of the preparation of the above table, and therefore not included in it.

(note 3) The amount of Medium-to-long-term performance-linked remuneration in the above table is calculated by deeming the number of shares corresponding to the number of points granted for the current fiscal year under the stock remuneration program as the remuneration for the year.

(note 4) Short-term performance-linked remuneration (on the company level) falls under the category of performance-linked remuneration. For this remuneration, the Company adopted consolidated operating profit as an indicator to appropriately and clearly reflect the Company’s business performance during a relevant fiscal year to the remuneration. The Company’s consolidated operating profit in FY2023 was ¥11,171 million.

(note 5) ESG-linked remuneration (to be paid from July 2024) falls under the category of performance-linked remuneration. To ensure this remuneration works as an appropriate incentive for achieving sustainability targets, sustainability indicators are used to evaluate achievements. Nominating/Compensation Committee evaluates achievements of targets for sustainability indicators, and judges whether this remuneration elements should be paid or not. For the payment in the current fiscal year, greenhouse gas (GHG) emissions reduction target (Scopes 1, 2)(compared to FY2017) set at 21.2% was used for the evaluation, but we actually reduced GHG emissions by 45.4% (in FY2023).

(note 6) Medium-to-long-term performance-linked remuneration falls under the categories of performance-linked remuneration as well as non-monetary remuneration. For this remuneration, the Company adopted its stock price, in order to appropriately reflect increased corporate value to remuneration amounts, and to share incentives for increasing corporate value with shareholders.

Succession Planning

The Nominating/Compensation Committee deliberates and determines the details of the succession plan for the management.

Succession Planning

Formulating Succession Planning

Cross-Shareholdings

Policy for Cross-Shareholdings

We will retain Cross-Shareholdings that we deem meaningful from the perspective of improving capital efficiency and necessity in our business activities, and will reduce those that we have decided not to have the significance of possession. Annually, at Board of Directors, we will verify the appropriateness of ownership of all listed company as Cross-Shareholdings and disclosure of the outline of the verification contents.

In the verification, we have an comprehensive perspective including methods of comparing the quantitative benefits holding of shares with the holding costs calculated from the market value and capital cost of the stocks, creating of business opportunities, and maintaining of cooperative relationships in business.

(note) We define “Cross-Shareholdings” as the “investment stock that its purpose for holding is other than pure investment purpose” in securities report.

For details, please refer to “4. Corporate Governance, (5) Shareholdings” in the Annual Securities Report for the 203rd Fiscal Year (April 1, 2024 to March 31, 2025).

Strengthening Internal Controls

The Company strives to strengthen the management structure and increase corporate value of the entire Group through the following measures: while respecting the independence of business management of subsidiaries/affiliates, the Company gets a picture of their overall business management, including compliance and risk management, and ensures sound management of each company by offering advice and support, etc. concerning the development of their legal compliance and internal control systems, and providing appropriate guidance about business management ; and the Company also dispatches Directors and other officers to the Group companies.

Status of development of internal control system

The Company believes that internal control is intended for maintaining/improving the efficiency of execution of duties, ensuring compliance, risk management, information management and group company management, and established and implements the internal control system.

For details, please refer to “4. Corporate Governance, (1) Overview of Corporate Governance” in the Annual Securities Report for the 203rd Fiscal Year (April 1, 2024 to March 31, 2025)and “System for Ensuring the Appropriateness of Operations”.

Developing business activities that consider climate change

Developing business activities that consider climate change Strengthening human capital and organizational execution abilities

Strengthening human capital and organizational execution abilities Building a governance system to strengthen risk management

Building a governance system to strengthen risk management