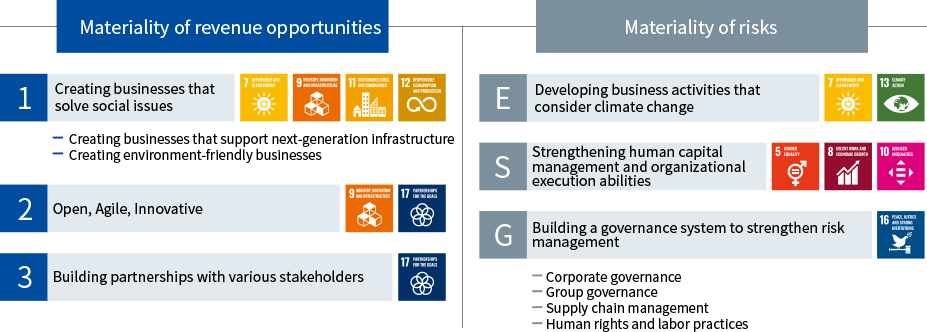

Strengthen the foundation for ESG management

Strengthen the corporate functions that support business growth

- Set the priority “materiality” directed at achieving Vision 2030

- Set “sustainability indicators and targets” to be achieved during the 2025 Mid-term plan

Sustainability Indicators

- By achieving the sustainability indicators that contribute to resolving the materiality, aim to achieve Vision 2030.

| Materiality |

|

FY2021

result |

FY2025

target |

| Revenue Opportunity |

1 |

Createing businesses that solve social issues |

Sales ratio of environmentally friendly products |

Consolidated |

61.9% |

70% |

| 2 |

Open, Agile Innovative/

Building partnerships with various stakeholders |

R&D expense growth rate for new businesses (compared to FY2021) |

Consolidated |

(100%) |

125% |

| 3 |

Implementation rate of IP landscaping for strengthening the businesses

and themes for creating new businesses |

Consolidated |

17% |

100% (Note1) |

| Risk |

E |

Developing business activities that consider climate change |

GHG emissions reduction rate (Scope 1,2) (Compared to FY2017) |

Consolidated |

▲29.0% |

(▲42%) (Note2) |

| GHG emissions reduction rate (Scope 1,2) (Compared to FY2021) |

Consolidated |

ー |

▲18.7% (Note3) |

| Ratio of renewable energy use to total consumption |

Consolidated |

10.9% |

30% (Note3) |

| S |

Strengthening human capital and organizational execution abilities |

Employee engagement scores (Note4) |

Consolidated |

ー |

80 |

| Ratio of female managers |

Non-

consolidated |

3.8% |

7% |

| Ratio of mid-career hires in total new hires(management, career-track, and clerial positions) (Note5) |

Non-

consolidated |

36% |

30% |

| G |

Building a governance system to strengthen risk management |

Ratio of follow-up on risk management activities for all risk domains |

Consolidated

|

88% |

100% |

| Ratio of SAQ implementation based on the CSR Procurement Guidelines for major suppliers |

Consolidated |

Non-

consolidated

20% |

100% |

| Implementation rate of human rights training for managerial positions (Note6) |

Consolidated |

ー |

100% |

(Note1)

This means that all projects have been implemented with respect to the business enhancement and new business creation themes set as of 2022.

(Note2)

Base year was updated to FY2021 upon the revision of Environmental Targets 2030; the reduction target value when applied to the former base year of FY2017 is also shown for reference.

(Note3)

Target value for FY2025 was updated upon the revision of Environmental Targets 2030.

(Note4)

Target value for FY2025 was newly set in FY2022.

(Note5)

This means that about 30% will be maintained in each fiscal year.

(Note6)

Started measuring from FY2022 and this means that 100% globally for each fiscal year will be continued.

Top of Page