Regarding the establishment of a magnet wire business joint venture with Superior Essex, and the contribution of the heavy magnet wire business to the joint venture

Furukawa Electric Co., Ltd. (the “Company”) has agreed to establish a joint venture, Essex Furukawa Magnet Wire LLC (the "Joint Venture") with its long-term partner Superior Essex Inc. (Atlanta, GA, “Superior Essex”), and will integrate its heavy magnet wire business and polyimide tub ("PIT") business (“Furukawa Business”) with Superior Essex's magnet wire business through a company split and investment in kind (the “Transaction”).

Through this Joint Venture, the Company will provide high value-added products and technological innovations required by customers globally.

Outlook and Purpose

The global expansion of the automobile electrification market brings significant business opportunities to the heavy magnet wire business, and is expected to increase in demand for high value-added products such as the Company’s HVWW® product line. On the other hand, overseas production and local customer procurement continues to develop, and there is a strong demand for a global supply of magnet wire products of consistent quality and design. In March 2017, the Company and Superior Essex’s German subsidiary established Essex Furukawa Magnet Wire GmbH (hereinafter referred to as "EFMWE") in Germany, targeting the European market; as a result of this Transaction, we decided to establish a system that can respond to requests such as global supply and BCP in order to integrate our magnet wire business globally.

Once approved by the regulatory and anti-trust authorities, the two companies are planning to integrate their businesses within a number of months.

Superior Essex is a long-time, reliable business partner, well-known to Western customers, and the world's largest enamel wire manufacturer, operating 12 manufacturing plants globally, including in the United States and China. Although the Company's management resources related to Furukawa Business are limited, as a result of this Transaction, the Joint Venture will be able to deliver technologies and products developed by the Company to customers globally that it would not be able to realize if the Company was on its own.

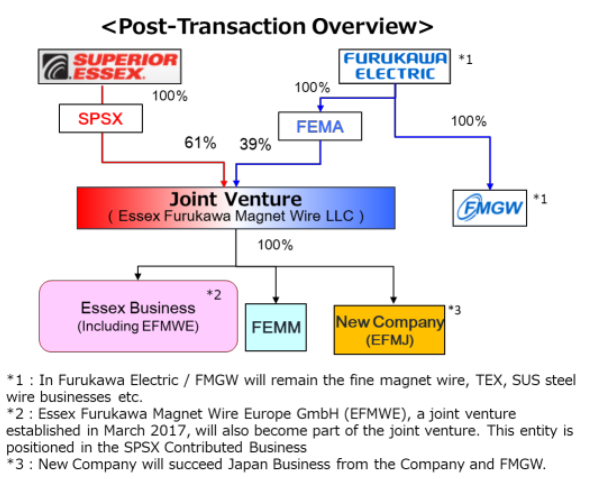

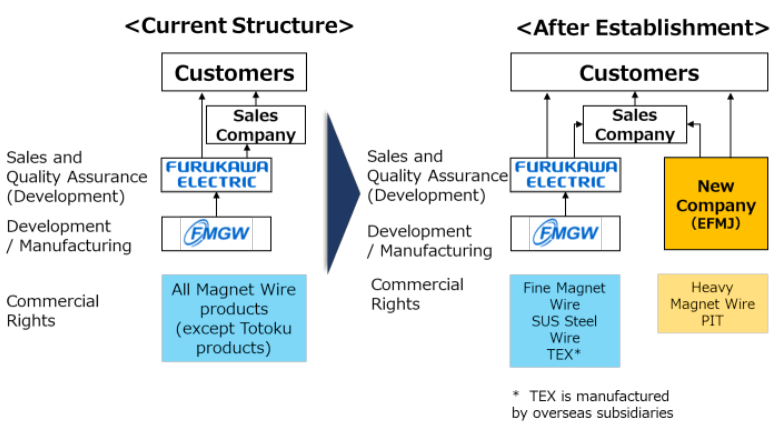

As a result of this Transaction, from within the magnet wire division, the heavy magnet wire division as well as the closely related PIT business (including the medical product Vasculex®) will be transferred to the Joint Venture, and as a result, the Company will within its group retain the fine magnet wire, triple insulated wire (hereinafter "TEX") and SUS Steel Wire business.

Overview of the Joint Venture

Target Business

- Superior Essex Magnet Wire Business and U.S. Varnish Business (“Essex Business”)

- The Company's heavy magnet wire business and PIT business (excluding the fine magnet wire business, TEX business, and SUS steel wire business)

Overview of the Transaction (see figure below)

The Company will transfer Furukawa Business via Furukawa Electric Magnet Wire America, Inc. (incorporated on September 6th, 2019,“FEMA”), and Superior Essex will transfer Essex Business via Superior Essex Holding Corp. (“SPSX”), to the company incorporated under SPSX (resulting Joint Venture will be 61% owned by SPSX and 39% by FEMA).

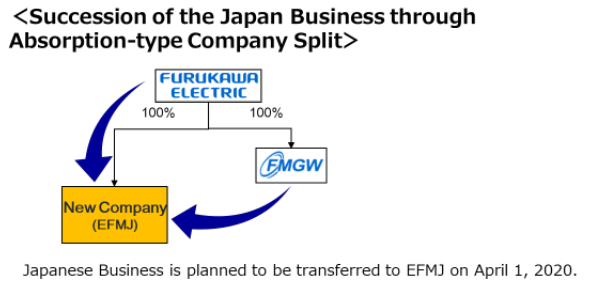

As a process of this Transaction, the heavy magnet wire and PIT business conducted by the Company and its wholly-owned subsidiary Furukawa Magnet Wire Co., Ltd. ("FMGW") (collectively, “Japan Business”) is planned to be transferred to the newly established wholly-owned subsidiary (hereinafter "New Company (EMFJ)") through an absorption-type company split. The Company will transfer all shares of the New Company (EMFJ) as well as FE Magnet Wire (Malaysia) Sdn. Bhd. ("FEMM") and also all of its 49% equity interest in EFMWE, to the Joint Venture.

Transaction Schedule

We are planning on finalizing the Transaction by April 1st, 2020.

Domestic sales system after implementation of the Transaction

- Outline of the New Company: The final business trade name, location etc. will be disclosed once they are officially determined.

- Sales structure after implementation of the Transaction

The New Company succeeding the heavy magnet wire and PIT business will operate the business going forward (however, we plan to have customers who have purchased through sales companies to be able to continue to do so going forward).

Expected impact on financial accounts as a result of the Transaction

The expected impact on financial accounts as a result of the Transaction is currently under review, and we will disclose as soon as we are able to confirm.

Share

Share Tweet

Tweet Share

Share